As the 2023 holiday season approaches, retailers and consumers brace for a market shaped by inflation concerns, changing shopping behaviors, and emerging technologies.

The impact of global economic conditions, the persistence of inflation, the rise of buy now, pay later options, and shoppers’ waiting for discounts will impact the 2023 holiday shopping.

What follows are five holiday-shopping predictions, and a report card, if you will, grading my predictions last year.

Here’s an AI -generated Santa Claus as a fortune teller predicting how the 2023 holiday shopping season will turn out.

1. Holiday Spending Grows Less Than 5%

Global economic conditions are not great in 2023. The first half of the year was similar to 2022, and, according to Numerator, a research firm, more than half of Americans are concerned about inflation and the specter of further economic slowdowns, with 22% of “holiday celebrators” saying inflation concerns would have a “significant” impact on their shopping, and 31% expecting it to have a “moderate impact.”

Separately, Salsify, a product engagement platform, estimated that 90% of global consumers in 2023 are “adopting cost-saving behaviors.”

With this in mind, I predict little holiday sales growth — below 5%.

Suppose overall inflation grows around 6% annualized in the last quarter of 2023. In that case, this prediction implies that while total sales would grow, that growth might not reflect a real increase since inflation would have driven up the dollar amount spent.

This prediction would buck a trend. In 2022, most retail prognosticators expected total U.S. retail sales to grow less than 6% when, in fact, retail sales rose more than 8%.

2. Buy Now, Pay Later Is 9% of Orders

Some shoppers will turn to buy now and pay later financing to make last-minute purchases, peaking at a record 9% the week before Christmas.

This prediction represents a significant but likely increase from 2022 when buy now, pay later sales represented 7% of all online orders.

Unfortunately, rising consumer debt is often a symptom of underlying economic problems. In the first quarter of 2023, total household debt in the United States, for example, reached $17 trillion, a record high. This rising debt represented a 0.9% increase from the fourth quarter of 2022 and is $2.9 trillion higher than at the end of 2019, before the pandemic recession.

If your ecommerce shop is not currently offering a buy now, pay later option, you might want to add one.

3. Discounting Drives Sales

In 2022, discounts and deals were the heroes of the holiday shopping season.

Rising inflation was expected to keep many shoppers out of the market, but retailers slashed prices, enticing gift buyers.

On Black Friday, when U.S. holiday sales hit $11.3 billion, according to Adobe, electronics were typically offered at an average 29.8% discount. Toys could be had that day for about 33.8% off, again according to Adobe.

Discounting on Black Friday is not new. But the discounts in 2022 were longer and relatively deeper in many cases. Most retailers offered double-digit discounts — up to 34%.

While inflation rates are falling in the U.S. and worldwide, don’t be surprised if discounting continues in 2023. Retailers will be tempted to repeat what worked last year, anticipating price-sensitive shoppers.

4. Shoppers Wait for Those Discounts

For years, Christmas shopping has begun earlier in the season. As evidence, note that Adobe included Veterans Day, November 11, on its holiday shopping report in 2022.

Adobe includes Veterans Day in its list of important holiday shopping days.

But what if 2022’s relatively heavy discounting has taught shoppers to play a waiting game? For example, in the U.S., toy prices were the lowest — averaging a 33.5% discount— on November 29 and 30, 2022, according to Adobe.

Hence some gift-givers will likely wait. They might start buying early but could spread that shopping out longer, waiting for last-minute deals.

5. Generative AI Impacts Product Discovery

This prediction is tough to measure but is nonetheless a trend that will impact holiday shopping. Consumers will use generative AI on Google and via ChatGPT to find Christmas gifts during the 2023 holiday shopping season.

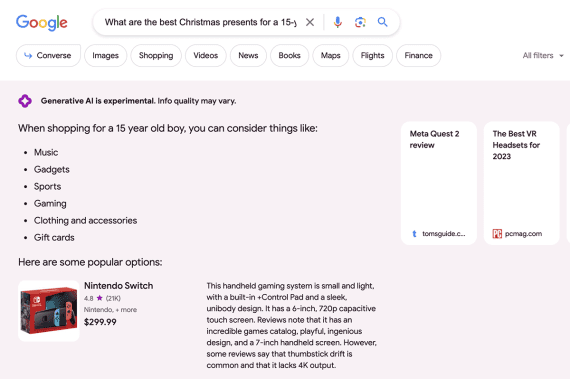

Most shoppers start their hunt for gift ideas with a search engine, but now for many Google users, a gift idea query will produce an AI response. Take my recent Google search, for example, seeking gift ideas for a 15-year-old boy.

When shoppers query Google, “What are the best Christmas presents for a 15-year-old boy?” they may receive both AI-generated and more familiar results. Click image to enlarge.

Moveover, expect some shoppers to ask ChatGPT. I entered this prompt:

I want to surprise my wife with a great Christmas gift this year, but I only have a budget of $150. My wife loves cooking. She likes wine. And she reads a lot of historical fiction. She hates pop culture and has not watched a movie in years. Please recommend some gifts.

ChatGPT responded with a list of ideas, including a cooking class, high-quality kitchen gadgets, a cookbook, and more.

AI’s impact on shopping is unclear but real.

Last Year’s Predictions

Every autumn since 2013, I have predicted ecommerce sales for the coming holiday season. Here’s how my 2022 forecast fared.

U.S. retail sales will grow less than inflation — wrong. In 2022, total U.S. retail sales for the year reached $7 trillion, up some $500 billion from 2021. That works out to be an 8.1% increase. Meanwhile, U.S. inflation rose 6.5%.

Inflation tops 6% worldwide by Christmas — correct. Worldwide annualized inflation fell to 6.5% in December but was still above the mark predicted in June 2022. In total, global inflation for 2022 was 8.75%, the highest in 26 years.

Marketplace sales will rise — correct. U.S. ecommerce sales rose just 3.5% during the holiday season, according to Adobe. It was still the largest-ever holiday season in terms of sales volume but had relatively slow growth. In 2021, for example, U.S. ecommerce sales rose 17%. By comparison, Amazon marketplace holiday sales jumped 9% year-over-year.

Holiday purchases will come early — correct. According to Deloitte, more than half of American shoppers started buying before Black Friday and Cyber Monday.

Mobile commerce will grow 20% — wrong. Depending on the source, sales on mobile devices increased by roughly 8% during the 2022 holiday season.